- call us now! 01482 692421

Growing Your Investments and Savings in Hull

Jul 25, 2024

If you are looking to grow your wealth with savings and investments, the tailored advice and financial planning services offered by our team of advisers in Hull can make all the difference. Especially when it comes to growing your investment portfolio. Whatever your savings goals are, long-term or short, we can help.

There are many strategies you can implement to grow your investments and savings, but finding the right financial product that suits you is essential.

How to grow your investments and savings

Using an ISA

Cash ISA

A Cash ISA is not so different from a regular savings account but has the added bonus of allowing you to earn tax free interest. Adults aged 10 or above get a £20,000 ISA allowance. Our team can help you to find which Cash ISA would suit your goals.

Stocks and shares

Stocks and shares investment come with more risk however, there is potential to earn more. Stocks are continuously up and down, so considering this and assessing the financial risk is vital. Again, there are many different Stocks and Shares ISAs on the market. Our experienced advisers can help you decide which is the most suitable for your financial situation.

Lifetime ISA

Lifetime ISAs are a great way to save for the future. They are available to UK residents between the age of 18-39. The benefit of a Lifetime ISA over other ISAs is that the government will add 25% to your savings (to a maximum of £1000 annually). If you are saving to purchase your first home, these ISAs can be cashed in at any time. However, if you are using a Lifetime ISA to save for any other reason, you will have to wait until you are over the age of 60 to access these funds.

Investing in Premium bonds

Premium Bonds are a risk-free investment option. Instead of earning interest, you enter a monthly draw to win cash prizes that are not taxed. The more you invest, the higher your chances of being drawn in the prize and increasing your savings.

Using a regular savings accounts

Regular savings accounts shouldn’t be dismissed by those looking to grow their wealth. They are a low risk saving option, ideal for those who are looking for guaranteed interest rates with no uncertainty. Selecting a bank that offers long term, high interest rates on your savings is advisable. This is because many high street banks offer an introductory higher interest rate for a limited time and, after this, your interest rates are reduced to a much lower rate. Alternatively, you can set reminders for when the introductory interest rate expires and switch to a different bank to take advantage of a better deal from their available offers.

Budgeting apps and tools

Putting aside money can be difficult. Many of our clients find that budgeting apps are helpful. They often allow you to set your income and saving goals and then create a budget for you. Some even have the facility to automatically withdraw money from your bank each month and transfer it to your savings account of choice, helping you to save without thinking.

What's the next step to take?

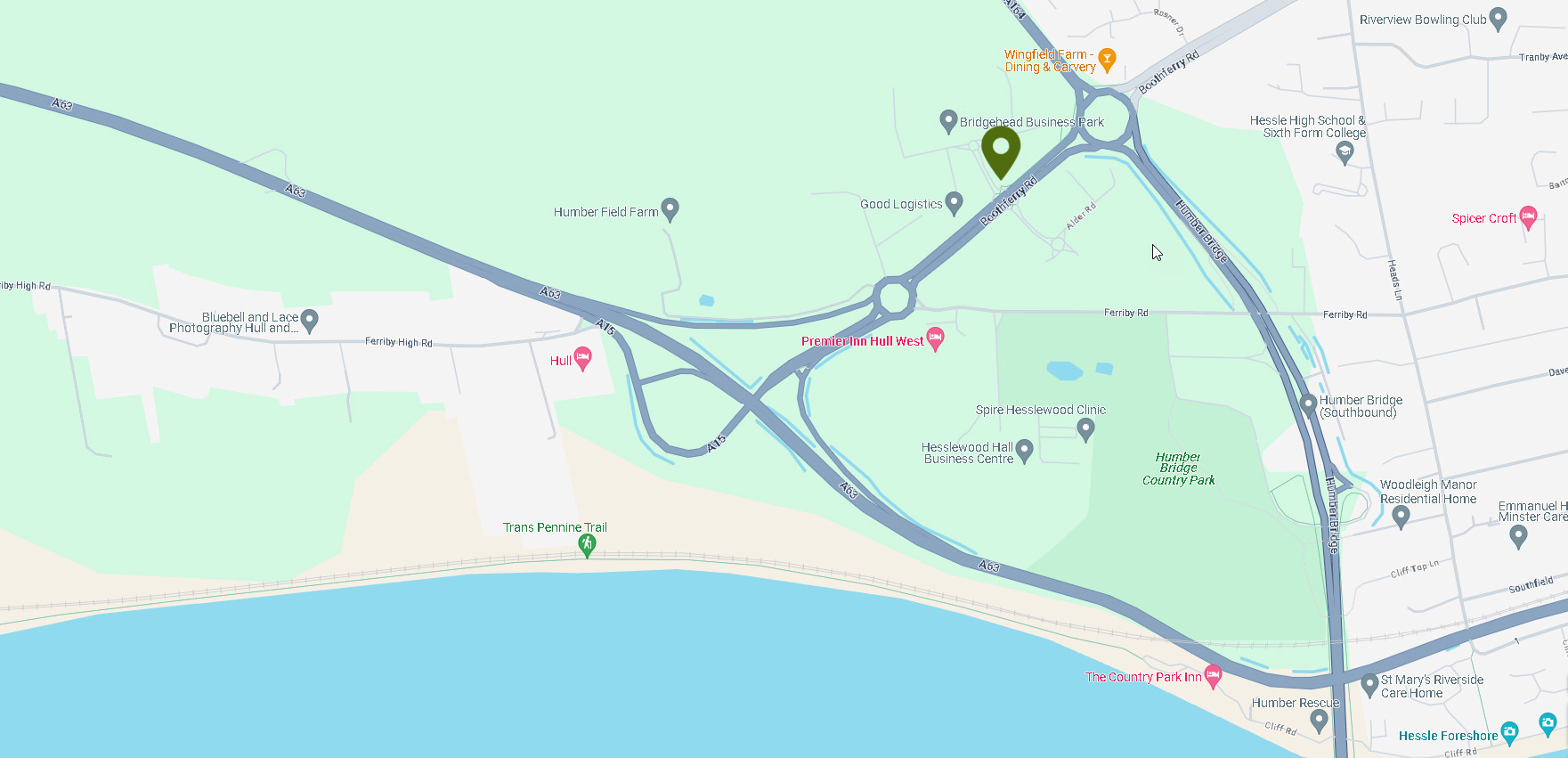

How you invest and save is completely up to you. However, speaking to our team of trusted financial advisers based in our Hull office can ensure that you are making the most out of your money and various methods and techniques available to grow your investments and savings.

Contact us to see how we can help you reach your savings goals.

FOR ISA’S INVESTORS DO NOT PAY ANY PERSONAL TAX ON INCOME OR GAINS BUT ISAS DO PAY UNRECOVERABLE TAX ON INCOME FROM STOCKS AND SHARES RECEIVED BY THE ISA MANAGER . TAX TREATMENT VARIES ACCORDING TO INDIVIDUAL CIRCUMSTANCES AND IS SUBJECT TO CHANGE.

YOU WILL INCUR A LIFETIME ISA GOVERNMENT WITHDRAWAL CHARGE (CURRENTLY 25%) IF YOU TRANSFER THE FUNDS TO A DIFFERENT ISA OR WITHDRAW THE FUNDS BEFORE AGE 60 AND YOU MAY THEREFORE GET BACK LESS THAN YOU PAID INTO A LIFETIME ISA.

BY SAVING IN A LIFETIME ISA INSTEAD OF ENROLLING IN, OR CONTRIBUTING TO AN AUTO-ENROLMENT PENSION SCHEME, OCCUPATIONAL PENSION SCHEME, OR PERSONAL PENSION SCHEME:

(I) YOU MAY LOSE THE BENEFIT OF CONTRIBUTIONS FROM YOUR EMPLOYER (IF ANY) TO THAT SCHEME; AND

(II) YOUR CURRENT AND FUTURE ENTITLEMENT TO MEANS TESTED BENEFITS (IF ANY) MAY BE AFFECTED.